Stock picking is an art. You must know the right time to get in or out. It is a skill you can acquire after years of practice. For most of you, it is not your core competency. Yet, you must know when to invest or exit an investment to make your money work. You need to understand factors that influence share prices and those that make a fundamentally sound investment.

A new working paper published by the Reserve Bank of India studies the impact of foreign direct investment on the profitability of Indian companies. The findings reveal that the profits of those companies that receive FDI have improved over the years. The quality of their balance sheet also enhances with a decrease in the leverage or indebtedness of these companies.

With interest rates holding firm due to stubbornly high inflation, businesses’ capital cost remains high. In that context, aligning your investments towards businesses with low indebtedness makes sense. The RBI paper argues that companies may have to sell assets to meet debt obligations. Long-term debt to total assets portrays the financial condition of a company and the company’s ability to repay its debt.

The other important parameter is the percentage of the short-term debt to total debt. “Excessive leverage may be detrimental to the company as it may hamper the ability of the company to repay its obligations during periods of stress,” the RBI paper argues.

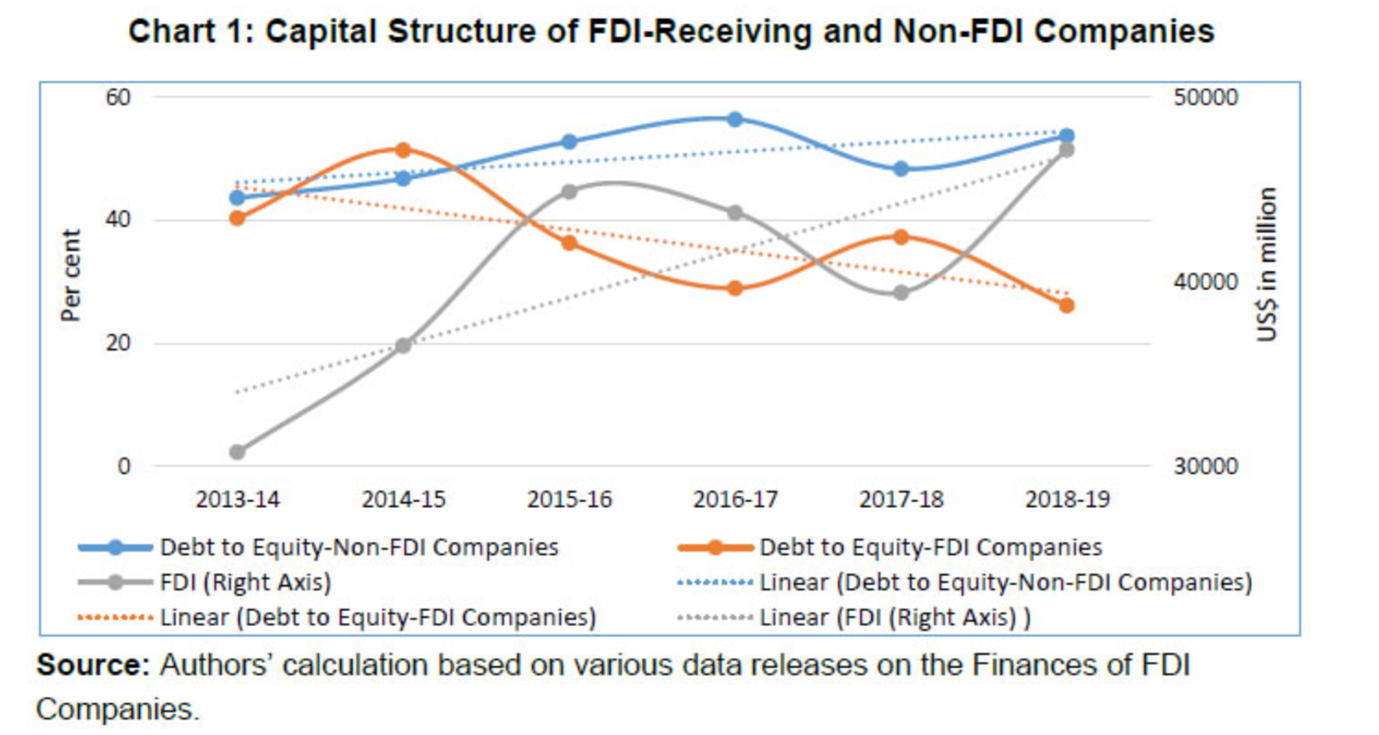

The chart above shows how companies with foreign direct investment have managed to bring down their debt-to-equity ratio. It increased steadily for the listed companies that have no foreign direct investment.

The analysis above is not something people who regularly invest in the stock market are unaware of. The stock market loves financially stable businesses that generate cash flows to pay for everything from expenditures to shareholder dividends. Investors chase fundamentally sound companies. The high price-earnings multiples enjoyed by big multinational companies in the consumer goods space can be explained by their near-zero or low debt. Some multinational pharma companies also enjoy high multiples. They usually have high foreign direct investment from a global company, most of which are their listed subsidiaries in India.

However, some companies in the mining and services sector also have a high foreign direct investment. Private equity investment is also construed as FDI. Indian companies have received investments primarily from countries like the United States, Mauritius, Singapore, Japan, UK, among others, according to the RBI paper.

From your standpoint, these data points show investing in companies with a strong FDI is a good idea. Most of these companies enjoy the interest of large institutional investors. They are profitable and pay dividends consistently. At the same time, they offer steady capital appreciation.

The challenge is to identify quality companies to benefit from investing. That process involves analysing data. You can do it on your own or take help from technology. Alphaniti can help you identify the right businesses.

Reference:

RBI | Impact of Foreign Direct Investment on Profitability

Thank you for reading this post, don't forget to subscribe!