What is Mutual Fund's expense ratio?

The most significant advantage of investing through mutual funds is that they are professionally managed by an asset management company (AMC). Naturally, these companies levy certain charges, known as the annual fund operating expenses or expense ratio, for managing the fund. This article will help you understand what expense ratio is, how it’s calculated, and how it impacts your returns.

What is Expense Ratio?

It’s the annual maintenance cost charged by mutual funds to their investors to finance the expense of managing a fund. Its components include annual operating costs such as management fees, advertising costs, allocation charges, and so on. The ratio indicates the cost of managing a fund on a per-unit basis.

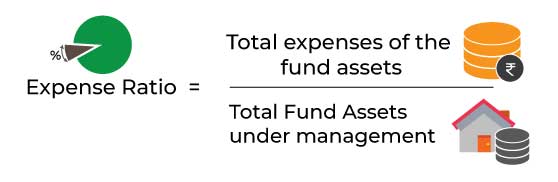

How is Expense Ratio Calculated?

Management companies calculate the expense ratio by dividing the total expenses of the fund assets by its assets under management. Since the fund house incurs these costs, they become part of the expense ratio. You can think of it as a service charge for taking care of your money, as it covers agent commissions and registrar fees, among other expenses.

The expense ratio is denoted as an annual percentage of the fund’s net assets and is disclosed regularly. This percentage indicates how much you’re paying the fund house out of the investment returns for managing your money. For example, if the expense ratio is 1 percent and you have invested Rs. 5,000, you are being charged Rs. 50 every year. These charges are announced under the ‘Disclosures’ section of your AMC’s website, so nothing is hidden.

What’s interesting to note about the expense ratio is that it has an inverse relationship with the size of the fund. For example, if you invest in large-cap mutual funds, the expenses will be much lower than the total asset value. Therefore, the greater the asset base, the lower the ratio and the total cost constant.

Elements of an Expense Ratio

As mentioned earlier, several components make up the expense ratio. With so many moving parts involved in ensuring a fund’s success, asset management companies need to allocate a fixed amount of resources to every investment pool, thus incurring various types of charges, such as:

Management Fees – That is reserved for the members of the company who are actively engaging with your fund. Their responsibility includes dedicating time and effort to finding the best opportunities for you through constant research and informed decision-making. As a rule of thumb, around 0.5-1% of the fund’s assets are set aside for management fees.

- Administrative Expenses – Everything from keeping track of your fund to maintaining records, sending you regular updates, customer support, and other aspects of communication are included in administrative costs. These are the charges to run your fund. Indicated as a percentage of the fund’s assets, these costs can vary from AMC to AMC.

- Exit Load – The idea of a mutual fund is to encourage saving for emergencies, rainy days, or specific goals in your life. In order to dissuade investors from withdrawing their money arbitrarily, AMCs charge a small amount known as the exit load when you decide to redeem your funds. Calculated as a part of your total investment, the fees usually stand at anywhere between 1 and 3%.

- 12B-1 Fees – Believe it or not, the expense ratio includes the amount spent on promoting a particular fund and making it known among the masses. Like any advertising and marketing endeavor, this requires a lot of research and information to be gathered, which is why it forms a tiny portion of the total expense ratio.

There are other components like an entry load, brokerage fees, maintenance charges, and so on. You can find the breakdown on the company’s website.

How Expense Ratio Affects Your Returns

Expense ratios are charged on a daily basis. This means if a fund has a high expense ratio, it might add up over the years and create a significant dent in your returns. Just as the power of compounding grows your wealth, so can it eat into your earnings over time. That’s why SEBI has intervened and set the upper limit for how much a fund house can charge investors. While equity mutual fund fees can be 2.25% of the daily net assets, debt funds can charge up to 2% of the same. These limits are decided according to the AUM or Assets Under Management of the fund.

Therefore, the lower the fund’s expense ratio, the less it affects your returns, and vice versa. If you are not earning more than a median amount of profit on your fund, a high expense ratio won’t make too much sense. However, most credible fund houses strive to put that money to use and fetch you maximum gains, so it might be worth it to invest with an AMC that has a moderate expense ratio of 1 to 3%.

Thank you for reading this post, don't forget to subscribe!