Mutual Funds for Beginners and Mutual Funds for KYC

One of the most important lessons of investment is ‘no one-strategy-fits-all’. Since investors are categorized by their age, investment goals, risk profiles, and other factors, their investment options should also vary accordingly. Whether you are in your early twenties, starting a new career, nearing retirement, or just hoping to diversify your portfolio with safer investment avenues, mutual funds are versatile and can cater to all your investment goals. That’s what makes them so increasingly sought-after as a mode of investment. Below, you’ll find a guide that explains what mutual funds are, how they work, why you should invest in them, and how to update your KYC details before you start investing. Let’s dive in.

What are Mutual Funds

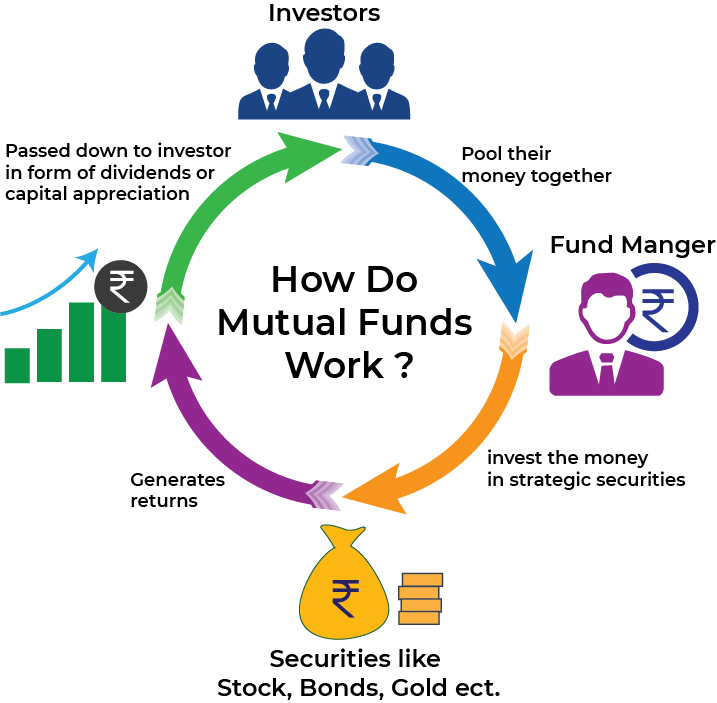

Mutual funds are created when an asset management company pools the investments from individuals and institutions according to their objectives. This pool is managed by a professional fund manager, who aims to generate the highest possible returns by investing the money in strategic securities. This is what sets the idea of mutual funds apart from other avenues. You do not necessarily have to be a market expert to begin your investment journey.

How Do Mutual Funds Work

A mutual fund works on the power of compounding. One way to earn returns is through dividends on the fund you have invested in, which can be received monthly, quarterly, or yearly. Upon receiving that dividend, you can choose to invest it back into the fund by buying more units. You will keep earning dividends not only on the original units but also on the new ones. Regularly doing this can result in higher returns over time.

Another way of earning returns is via capital appreciation, which refers to an increase in the market value of an investment. Calculated as the difference between the sale and purchase price, capital appreciation might occur in various investments like equities, mutual funds, real estate, gold, and other commodities. Different asset classes grow at different paces, and the capital might appreciate over short or long periods. In mutual funds, appreciation depends on a company’s financial performance, the overall sectoral performance, and the demand and supply of the security.

Why You Should Invest in Mutual Funds

Whether you have a certain financial goal in mind or would like to save up for a rainy day, mutual funds can prove to be a beneficial investment for different types of investors. Here’s how:

Easy to Begin

As complex as it may seem, it’s easy to start investing in mutual funds. You can start with a mere Rs. 500 a month through an SIP (Systematic Investment Plan) and build up your portfolio. In case you have been saving up for a while, you can also opt for lump sum investment plans.

Diversified Portfolio

Mutual funds offer an abundance of investment options like stocks, bonds, debt securities, and so on. By understanding the functions and benefits of these different classes, you can make educated decisions about the best possible way of growing your wealth. Investing in more than one fund is always a good idea because it lowers your risk and increases the chance of earning returns.

Tax Saving

The fact that mutual funds branch into so many different types is their greatest strength. There are some funds designed to save taxes, such as ELSS funds. Ideal for investors seeking mid-term options, ELSS funds come with a lock-in period of 3 years and help you reap tax benefits under Section 80C. However, you should learn the fundamentals of any fund you are interested in and understand its risks, rewards, and tax provisions before investing.

Easy to Access

You don’t need to go through hours of paperwork to start investing in a fund these days. You can research different funds online, speak to a professional manager about your goals and risk appetite, and find the fund that may serve you best. There are multiple platforms designed for beginners to start investing from the comfort of their homes. But first, you need to make sure you update your KYC details.

How to Do Mutual Funds KYC

Compliance with Know Your Customer (KYC) is compulsory for any investment in the financial market. All KYC records are maintained by entities registered with SEBI, and the process can be carried out both online and offline at their offices. The online method will require a scanned image of your ID, signature, address, and photograph. Offline, your documents will be physically verified.

Here’s a list of documents you need for KYC:

Fund name and folio number

Self-attested copy of PAN card

Proof of Identity

Proof of Address

Once you are KYC-compliant, you will not need to repeat the process for every transaction. However, do make sure your PAN card details are updated and your KYC status is confirmed.

So, now that you know what mutual funds are in a nutshell, read more about them and consider investing in funds of your choice for a financially secure future.

Thank you for reading this post, don't forget to subscribe!