There is an uneasy calm prevailing in financial markets. Bond markets have been showing an inverted curve for some time now in the rich world. Short-term interest rates are higher than long-term interest rates. Whenever that happens, a recession looms. Historically, that was the trend. The calmness in the global financial markets comes from a belief that we have reached peak interest rates. The way forward is for interest rates to remain flat and eventually decline.

The biggest problem is the looming recession in America. With inflation stubbornly high and jobs data unencouraging, the US could see stagflation. At the same time, if the US government defaults on debt obligations, it could trigger a panic selloff in the bond markets and push bond yields even higher. That could hurt the world economy already reeling due to inflation and supply chain shocks. The developed world is witnessing an inverted curve that could dramatically slow economic activity. It is bad news for countries dependent on exports to these rich countries. Oil prices have already been corrected, and so have other commodities.

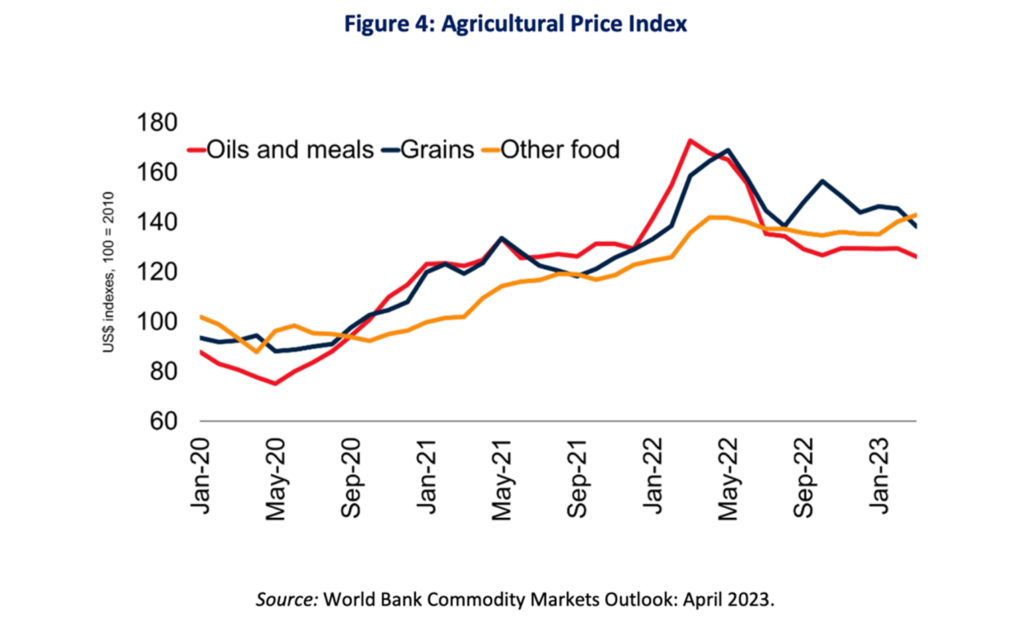

The latest World Bank Food inflation update highlights that in the first quarter of 2023, global commodity prices fell 14%. By March 2023, they were about 30% below the historic peak of June 2022. “Slowing economic activity, favourable winter weather, and a global reallocation of commodity trade flows have largely mitigated price increases after Russia invaded Ukraine,” the report states. In the same breath, though, the report warns against potential pitfalls. Wheat and maize prices decreased 8% in the first quarter, but wheat prices were still 100% above their 2015-19 average, and maize prices were 80% higher, the World Bank report observes. The World Bank expects food commodity and fertilizer prices to fall steadily, but a lot depends on the geopolitics. Ukraine and Russia are critical exporters of fertilizers, oilseeds and other commodities. If supply agreements are not adhered to, global food prices could surge.

In India, there is a sentiment of fear and caution. However, China and India stood out in inflation management in 2022. Financial markets are not concerned about prices in these countries. The 10-year bond yield is at its lowest in 12 months. The yield curve is flat if you compare long-term and short-term bond yields. The risk premium on Indian assets has dipped with inflation lower than that in the developed world. Government finances are more robust, with a solid monthly collection of goods and services tax. Indian equities are already at a record high and have barely moved over the past 18 months. If India’s growth remains steady, earnings growth will steadily catch up with valuations. Indian equity assets are trading at a price-earnings multiple higher than the 10-year average. Any selloff by foreign portfolio investors in a global panic could hurt Indian equities. If share prices do not run away significantly, earnings could catch up with valuations and make Indian shares attractive over 6-12 months. You may want to identify winners under such a scenario. Alphaniti can help you in your effort.

Thank you for reading this post, don't forget to subscribe!