In US, fractional ownership allows you to own a small part of one equity share. For example, if shares of Apple are traded at $170 per share, you can own half a share or a quarter share for a proportionately lower price. That makes shares listed in the United States is affordable for everyone looking to diversify their portfolio. You get the returns in proportion to your ownership, which applies to even the dividend paid out.

As an investor you currently have an opportunity to create a robust international portfolio that gets a boost with fractional shares. You can now own iconic American companies like Apple, Alphabet, Microsoft or Coca Cola and add an international edge to your portfolio.

Infact, if you are a relatively risk-averse individual, you could opt for exchange-traded funds with underlying shares listed in the US. These are popular ETFs owned by a large section of the US population. Some trade at over $ 100 per unit (Rs 7,600). You can buy fractional ownership in these ETFs too.

Presently, investing in fractional shares is possible only in the US market. This may soon change. The Policy makers in India have been putting in place a framework to introduce fractional shares in India ( based on media reports). This can be the biggest step to democratise wealth in India and allow all sections of income earning households to participate in the Indian markets.

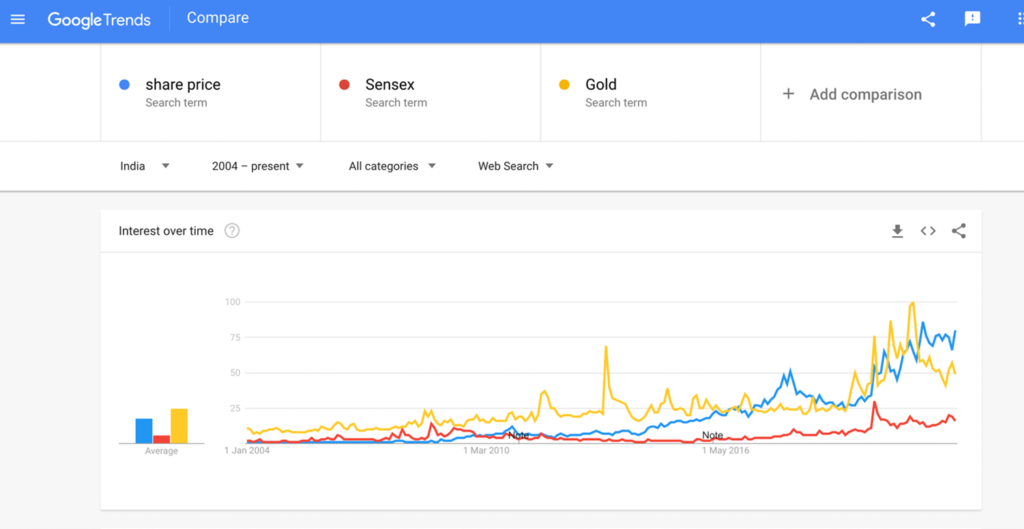

There is a compelling need to allow investors to own shares in fractions. That would expand the scope of financial inclusion and enable people from all income and wealth strata to participate in the growth of quality companies that grow consistently. The Google user interest is increasing in stocks. Looking up the Google Trends chart for search terms for the past 18 years, ‘share price’ has outperformed other words like ‘Sensex’ and ‘Gold’ over the past few years. Google users are searching for individual share prices of companies much more than just the Sensex or gold. Over the years, the number of online users who can search regularly has increased significantly. The rising interest of users coincides with a sharp surge in the registration of new investor accounts. The number of Demat accounts held by depositories was hovering around 25 million for a long time. It has more than more than tripled over the past three years.

The India growth story is a multi-decade saga. As Indian economy transitions from a developing economy to developed economy there is huge amount of wealth creation that will happen for generations to come. In US the household participation in stock markets is more than 50 pc, UK greater than 33 pc and even China in excess of 13 pc. In India, despite the significant growth over last three years household participation is still abysmally low at around 5 pc. Introduction of fractional shares in India is a pathbreaking reform that will lead to explosive growth in investing and wealth creation by vast sections of the society. India, the world’s largest democracy will then be also rightfully crowned as the largest democratised stock market in the world.

References:

Is Fractional Investing In Indian Stocks Possible? What Nithin Kamath Says | Mint

Thank you for reading this post, don't forget to subscribe!