Corporate balance sheets are boring to read. Yet, they matter the most to your investment. If you are constructing a long-term portfolio, you must understand the importance of the strength of the corporate balance sheets. Companies can fund growth using their resources, which sets quality companies apart. The company’s cash flows should be adequate to help the business grow.

That will ensure that your investment can sustain a phase of growth needed for you to make the necessary gains.

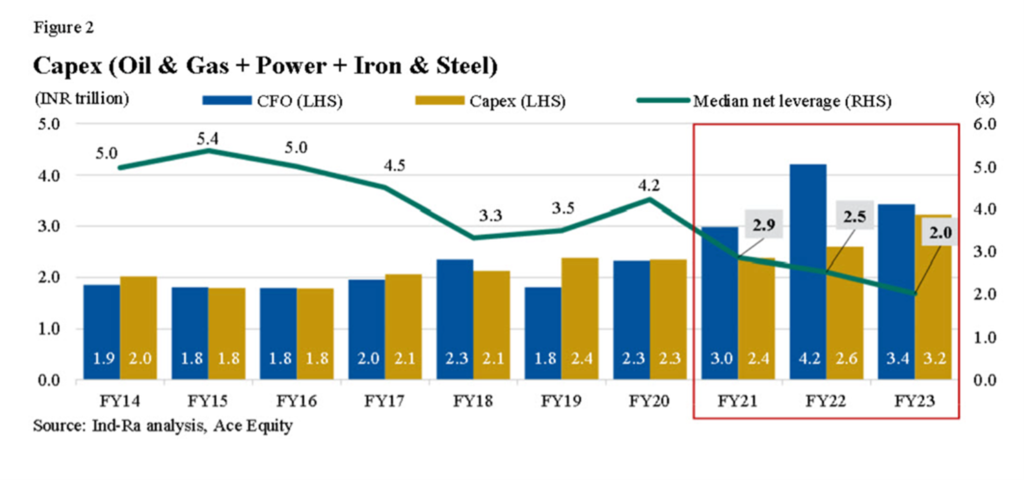

There are several data points you can refer to analyse this strength. You need businesses to generate steady revenue growth and profits to create a balance sheet that turns into an engine of growth. A new analysis published by India Ratings, an India affiliate of global credit ratings agency FITCH, shows that corporates are increasing their capital spending following an improved demand outlook. However, they are not overspending. “The capex increased at a compounded annual growth rate (CAGR) of around 4.6% as against the 8.2% increase in cash flow from operations (CFO) between FY14-FY23,” the latest study finds.

The analysis suggests that the improvement in CFO has been more than the capex requirements, resulting in the reduced need for relying on external finance for funding the capex.

If you look at the chart, you can see that the cash flow from operations has consistently stayed higher than the expenditure by companies.

Some large companies are surprising the market with their balance sheet strength. Larsen & Toubro, the largest engineering company, announced a buyback of shares for the first time in history. The company plans to pay shareholders Rs 3,000 per share against the current market price, which is nearly 10% lower. That is possible only when the company generates cashflows much more than the money required to fund growth. L&T’s strategy to reward shareholders shows that the company has more cash than it needs. It is strange for a capital goods and engineering company as they need sizeable funds to bid, operate or execute large infrastructure projects. L&T shares jumped soon after the announcement. The share price gained over 50% in value in just a year, outperforming the benchmark S&P BSE Sensex or Nifty benchmark.

The balance sheet strength is rewarded by the market too. For many years, investors preferred cashflow-generating software services companies. They never borrowed from banks and funded all their growth with cashflows. In the latest quarterly financial result announcement in July 2023, TCS said the company has free cash flow from operations of over $1.2bn, while Infosys said it had close to $700m. Companies with so much cash-generating ability can plan future growth efficiently. The allocation of resources is a corporate governance skill. Corporate managements have to utilise the money that belongs to shareholders efficiently. If there is no adequate utilisation of these free cashflows, managements pay high or special dividends. If you wish to create a basket of securities with solid balance sheets, you can use technology to identify such companies for your portfolio. Alphaniti can help you in the endeavour.

References:

https://www.indiaratings.co.in/pressrelease/62734

Thank you for reading this post, don't forget to subscribe!