If you want to build an aggressive portfolio, you must take risks. In the early days of your work life, that is possible. Even then, your investments need the proper asset allocation. You need to have the right amount of equity ownership in your portfolio. Regarding asset classes, it is a widespread perception that equity ownership should go down with age. That is said because your ability to withstand losses diminishes as you age. However, you could still own equity assets if you have strong cashflows after retirement. Your risk appetite is a function of your future income. Your confidence in your ability to generate an income that can create a sufficient investible surplus gives you the cushion to take risks.

Within the equity asset class, India is one of the few markets in the world to offer diversity in sectors and size. Stocks of market value Rs 5000 crore to Rs 20,000 crore are called midcaps, and those above Rs 20,000 crore are called large caps. Your long-term portfolio should be a combination of large-cap and mid-caps.

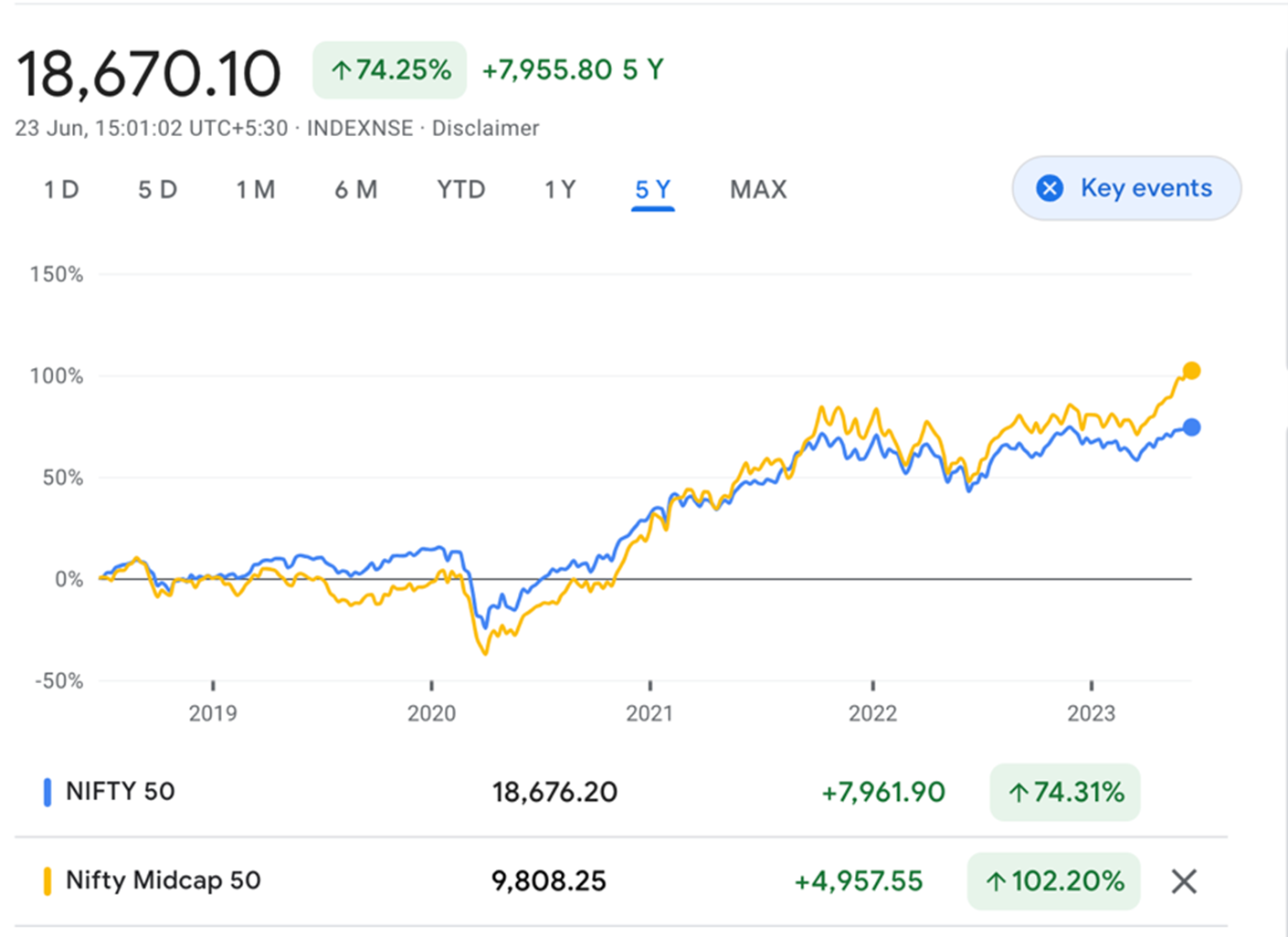

In 2023 so far, midcap shares have outperformed the large caps. With benchmark indices like NSE Nifty and S&P BSE Sensex scaling peaks, the interest in midcaps and smaller market value companies appears to be rising. That is an indicator of the improvement in the risk appetite. As India’s economic growth finds a way to inch forward, businesses dependent on economic growth are likely to do better. Over the past five years, the NSE Midcap 50 has seen its value double or grow over 100%. During the same period, the NSE Nifty index gained over 70%.

Source: Google Finance

Identifying winners

Today’s midcap shares are tomorrow’s large-cap shares. Quality companies that generate steady profit growth can slowly move up the market cap category. The trick to looking for midcap winners is first to determine sectors. With the government making capital expenditure a priority, businesses that earn revenue from government contracts could be a target. As India builds roads and people buy more cars, the automobile sector could find a place in your portfolio. However, most original equipment makers or car companies have run up significantly. You could look for businesses that act as a support system for original equipment makers. For example, recently, the government made it compulsory for large truck makers to ensure driver cabin air-conditioning. In tropical conditions, fatigue among drivers is a cause of accidents and low productivity. Cabin air-conditioning is expected to boost the output of transport companies. That has made businesses supplying air-conditioning to trucks attractive. Most of the auto-ancillary companies are in the mid-cap to small-cap categories.

Thank you for reading this post, don't forget to subscribe!