Stock market investing is not a daily activity. You must give your money time to grow. It grows as it rides through economic and stock market cycles over the years. We are in a world where we have quickly swung from a phase of abundant liquidity to a period where monetary tightening is all set to suck money out of the global financial system.

The Selling By Investors is Global & not restricted to India

The world’s financial markets are currently in a ‘Risk-off’ mode. Passive funds, active funds, hedge funds, Sovereign Wealth Funds and many other institutional investors are pulling out of emerging market equities and bonds and looking to park their money into US-dollar denominated assets, primarily US treasuries. Infact in India, through CY2022, foreign portfolio investors have already pulled out over Rs. 2.2 Lac Crores which amounts to roughly 1.2% of the entire Market Capitalization. To put this in perspective, the last time such pace of selling transpired was during the 2008 GFC era which resulted in Sensex crashing by over 50% in just 3 quarters!

Indian Markets have remained resilient so far

But despite such a brutal selling spree by Foreign Portfolio Investors, Indian broad-based indices have so far remained resilient ever since topping out in October 2021, with the Sensex showing a drawdown of ~15%. A primary reason for that is strong inflows by Indian households and retail investors into the market either via the domestic mutual fund route or through direct participation in the equity markets.

This is important as the increase in the total registration of Demat Accounts has witnessed a quantum leap since the pandemic lows of 2020, jumping by as much as 2.2x to ~90mn accounts as in April 2022!

Let’s check some insights related to markets to help you make an informed decision…

After the recent fall in the markets, Nifty Trailing P/E ratio is currently trading at ~19x which is at a significant discount of 30% to its 5 years average of 27.5x and a 15% discount to its long-term average of 22.50. The irony is that this is close to the P/E ratio of 17.2x hit during the March 2020 Covid lows.

During black swan events such as the one we are experiencing currently, like Russia-Ukraine War, COVID and many more, there is a possibility of earning disproportionate returns.

Such phases in the markets do not last forever. There are business and economic cycles, and you need to align your investments to discipline and hang in there! Short term volatility should not influence long-term investing strategies.

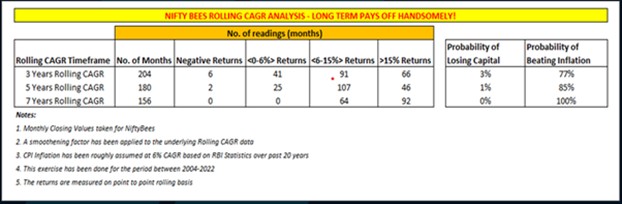

For instance, an analysis on 18 years’ worth of data on the Popular ETF from the house of Nippon India Mutual Fund, the Nifty BEES, clearly shows that regardless of what time an investor chooses to make his/her investment in the market, simply by staying invested for a period of 5 or 7 years would result in almost a ZERO percent chance of the investor losing capital. Infact, being invested for a period of 7 years resulted in inflation beating returns each time! The same study for 5 years and 3 years also shows very promising results (Refer the table below)

For an individual investor it is very hard to time the market. Yet the biggest amount of procrastination by investors is around ‘timing’ their investments in any asset class. While this may be true in asset classes such as Real Estate, where the ticket sizes are huge and bulky, due to the powerful SIP tool in liquid asset classes such as Mutual Funds, ETFs and Stocks, all investors need to adopt is discipline in these liquid asset classes. As such timing does not really play a big role in the overall return curve as much as simply sticking to a game plan does!

It is also important to remember that while discipline is paramount towards attaining the goal of wealth creation, each market cycle has its own set of leaders and losers. Not all sectors fire up at the same time and rotation is the name of the game! So, it can get challenging in trying to make the right allocation to the right sectors over the medium to long term.

But yes, this is where the hard work by advisers such as us come in! So don’t worry, leave the hassle of stock selection and allocation to us. All you need to do as an investor is welcome the current bout of market volatility and correction with open arms as you get the opportunity to participate in good quality businesses which are currently going at a discount.

So if you decide to ponder over your investment portfolio this weekend, remember this one rule.

Periods of high positive returns lead to periods of low or negative returns which again lead to a period of high positive returns.

Markets are cyclical. Make the cycle your friend. Not your enemy!

Thank you for reading this post, don't forget to subscribe!