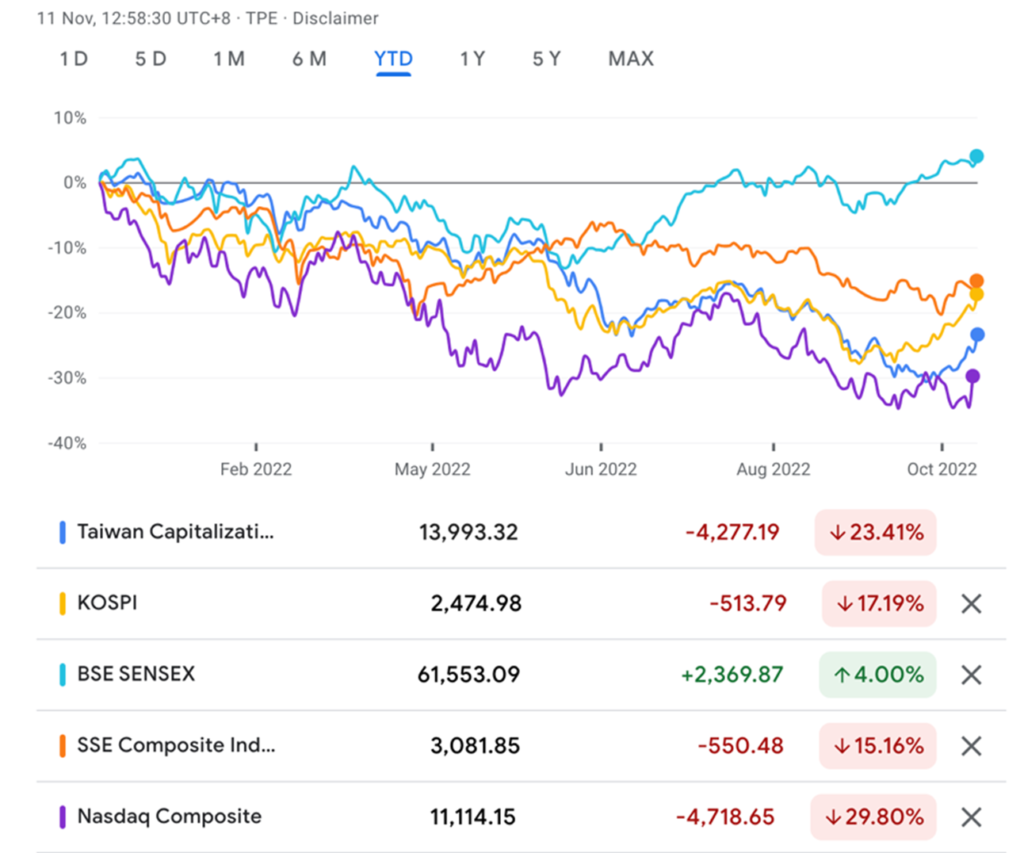

The year 2022 brought turmoil to financial markets. Rising interest rates and inflation took the wind out of equity prices. Major indices in the US, Europe and Asia shed 20-30% since January 2022. India stood out, though. Shares held their ground even as foreigners sold off due to the ‘risk off’ strategy. As the chart for the year shows, Indian equity indices decoupled from other benchmarks around August 2022 and continued to do so. Traders and investors are hopeful about the future outlook for India in a situation where rising bond yields are making global fund managers pull out money from risky asset classes.

There is a global consensus that India will continue to grow faster than any other major economy. Domestic demand and consumption would drive India’s growth. The limited dependency of Indian businesses on global supply chains or exports makes India an attractive destination. At the same time, the China + 1 strategy of multinational corporations is likely to help India increase manufacturing activity.

India does not remain immune to the world’s problems. There is a decline in the GDP growth on a compounded annual growth rate or CAGR basis to 2.7% during the three financial years 2022-23. It was 6.3% for five years to 2019-20, according to India Ratings, a credit rating agency owned by FITCH, a global agency.

“India, with a CAGR growth in the range of 4.6%-5.1%, would be the fastest growing economy among all the G20 nations during FY26-FY28,” the agency predicts.

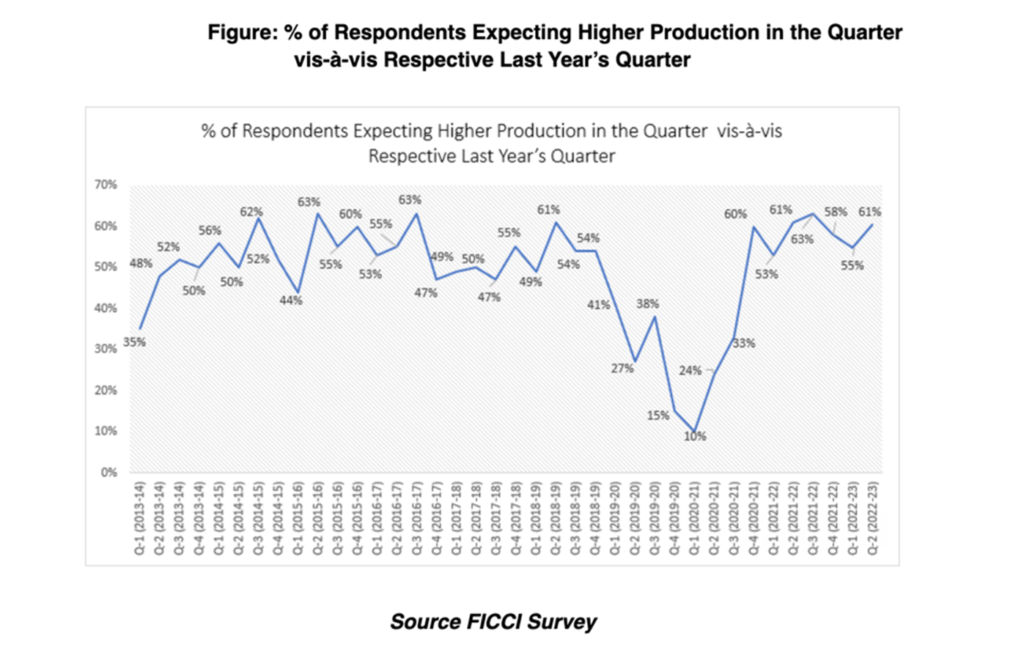

A survey of manufacturers by the Federation of Indian Chambers and Commerce and Industries or FICCI highlighted that about 61% of the respondents expect a higher production level from the quarter to September 2022 than the year ago. After relatively lower production for two quarters, it appears to be picking up.

There was a 15.7% growth in non-food credit in September 2022, which indicates an increase in the underlying economic activity.

While most production is now near the pre-pandemic levels, it needs to grow faster for any substantial profit growth for businesses. The FICCI manufacturer survey indicates that growth in only the automobile and textile sectors would remain strong (over 10%), while for most other manufacturing sectors, it would be moderate. Inflation continues to remain high at both retail and wholesale levels. That should ensure that interest rates would continue to rise or hold firm. The cost of borrowing for businesses benchmarked to the 10-year government bond yield hovers around 7.5%. That is more than a per cent higher than last year. Any slowdown in the profit growth of businesses would stall any potential rally in the Indian stock market. The quarterly results show a mixed picture.

Of the 28 NSE Nifty companies that announced quarterly results, only eight beat market expectations and 10 fell below expectations. The rest just about met expectations. Even then, the premium Indian equities enjoy over other peer markets has increased in 2022. Expectations from businesses in India are always higher than those in other markets.

A consistent dividend-paying company that generates cash flows every quarter is desirable for investors. A diversified portfolio could be a good idea in these times. Alphaniti is here to sort your investments within a few clicks with our thematic alphamatters. Go on and check them out at www.alphaniti.com now.

References:

India Ratings and Research: Most Respected Credit Rating and Research Agency India

Should your investment portfolio be ‘Made in India’ only? | Mint

Thank you for reading this post, don't forget to subscribe!