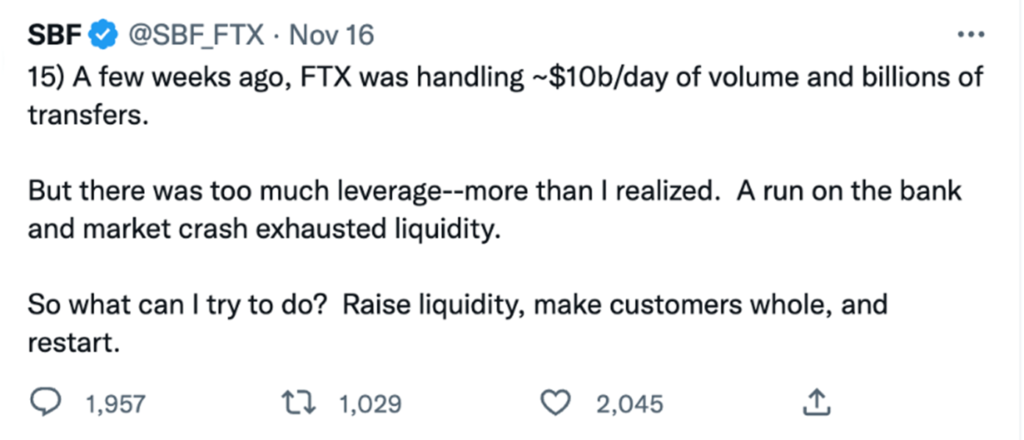

Sam Bankman-Fried, the founder of FTX, wants to set things right after the company’s spectacular collapse of a cryptocurrency exchange. He took to Twitter to give his side of the story. However, there is more outrage over the admission of guilt and an apology.

People want their money back. The bankruptcy of FTX so far has not affected er markets yet. However, financial markets are nervous.

The valuation of FTX hovered around $32bn not long ago, but the crypto exchange is now in bankruptcy, awaiting a bailout. It took barely ten days for potential leverage and solvency concerns to take it down. It was not supposed to lend to firms that are trading members. However, a sizeable chunk of $13bn of questionable lending was to a firm owned by the founder.

Contagion unlikely

The US Dow Jones Industrial Average jumped sharply on 10 November after the consumer price inflation data in the US was lower than expected. Financial markets saw that as the topping of the interest rate cycle. There is hope that the intensity of the rate hikes will slow as inflation peaks. It may be just too early to celebrate. FTX filed for bankruptcy, putting the cryptocurrency markets in turmoil on 11 November. Since then, equity markets have been marginally down. The euphoria about the taming of the inflation beast did not last long. Meanwhile, significant cryptocurrencies took a knock over the past ten days. They are down by at least 20% to 30%.

Although there is little direct connection between regulated financial markets and crypto exchanges, nervousness hurts the sentiment. Investors stuck with crypto currencies want to sell and convert their holdings partially into cash.

What could go wrong

For markets already beaten down, there is a limited downside. However, for India, risks could be more than in many other countries. The financial results of major companies for the quarter to September 2022 are a mixed bag. The expensive valuation of Indian equities could prompt foreigners to pull money out of India and move to cheaper markets. Money could flow out of domestic assets to foreign assets. That could hurt equity markets in the short term.

The successful taming of the inflation beast has opened up new investment opportunities. However, the US Federal Reserve is unlikely to hint at any lowering of the guard. There is excitement about China announcing relaxations in the stringent COVID-19 norms. That should ease the pressure on the Chinese markets. Major China markets reacted positively to the development. With the US and other significant markets shedding nearly 30% value in 2022, they could be attractive to returning investors along with the Chinese, Korean and Taiwanese equities. Indian equities, on the other hand, have shown resilience during the year so far. While the sentiment is optimistic about Indian shares, mid-caps continue to underperform. Investors are choosing large caps over mid-caps to minimise the downside risk to their portfolios.

You need to get the right mix in your portfolio to protect yourself again any potential volatility.

So, if you consider allocating more resources to equities, you may want to get the proper asset allocation. While diversification across asset classes is mandatory, you need to look at equity assets outside India too. A diversified portfolio could be a good idea in these times. Alphaniti is here to sort your investments within a few clicks with our thematic alphamatters. Go on and check them out at www.alphaniti.com now.

People want their money back. The bankruptcy of FTX so far has not affected er markets yet. However, financial markets are nervous.

Thank you for reading this post, don't forget to subscribe!