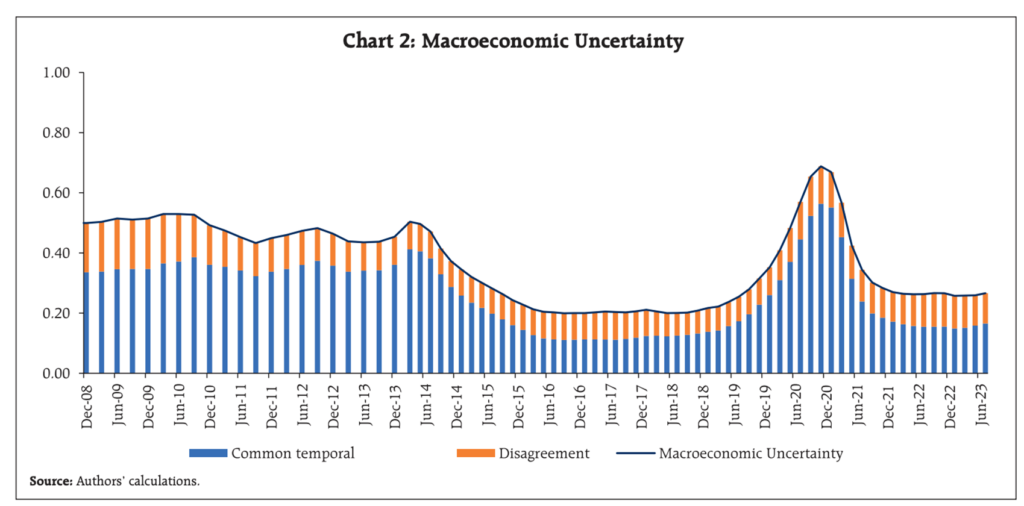

In an uncertain world, forewarned is forearmed. An article published in the Reserve Bank of India’s October 2023 monthly bulletin and written by a team of writers led by RBI deputy governor Michael Debabrada Patra attempts to measure uncertainty. It puts together the data from the survey of professional forecasters and constructs a model. The calculation shows that the uncertainty was high soon after the global financial crisis in 2008 and lasted till 2013. It declined after that and was subdued till 2019-20. Uncertainty shot up during the COVID-19 pandemic but then ebbed from 2022.

Why uncertainty measurement matters

Any spike in uncertainty stalls the economy. Households tend to save money and cut spending. The same applies to corporates. They stall future expansion and conserve capital. A credible measurement model for uncertainty and forward-looking surveys published could work as a lead indicator for various stakeholders. The Reserve Bank of India’s monetary policy committee can prepare for such an eventuality. They could look for the headroom to reduce borrowing rates without stoking inflation. Overall, the inflation and interest rate risk to the market needs to be minimised.

The new methodology talked about in the recent article is based on two types of uncertainties. These include standard uncertainty and idiosyncratic uncertainty. The common uncertainty is the variation in uncertainty across different economic variables and different forecasters that are common to all. An idiosyncratic component is the degree of disagreement among professional forecasters on their views about the future economic state.

The model is perhaps used by analysts tracking the US economy while commenting on the future of US interest rates. There are many diverse viewpoints. The US economy is growing briskly despite rising 10-year bond yields and inflation. The job market continues to remain strong. A recent note by Morgan Stanley, a global bank, warns against complacency and advises clients to exit overvalued stocks.

“The current federal debt pile is already massive, at more than $33 trillion, a staggering post-WWII high representing 122% of gross domestic product (GDP),” the bank observes in the note. If US markets tank as bond yields hover around a record high of 5%, it will have a contagion effect on global markets. The bank urges its clients to increase the ownership of physical assets like commodities and real estate. There is already a surge in gold prices.

From an Indian standpoint, that recommendation makes little difference, as most Indian households are invested in real estate and gold. If you are an active investor, you need to learn about the impact of uncertainty on your portfolio. The month of October has witnessed a selloff already. You can move towards owning businesses with solid balance sheets and cash flows. With the government continuing to spend on public infrastructure, Indian equities offer a diverse pool of businesses to park your money pulled out from overvalued assets. You can either identify the right basket of stocks yourself or get help from technology to arrive at it.

References:

https://rbidocs.rbi.org.in/rdocs/Bulletin/PDFs/02AR201020237E00A2B2580C4D83838A7EDD080B75AB.PDF

Thank you for reading this post, don't forget to subscribe!