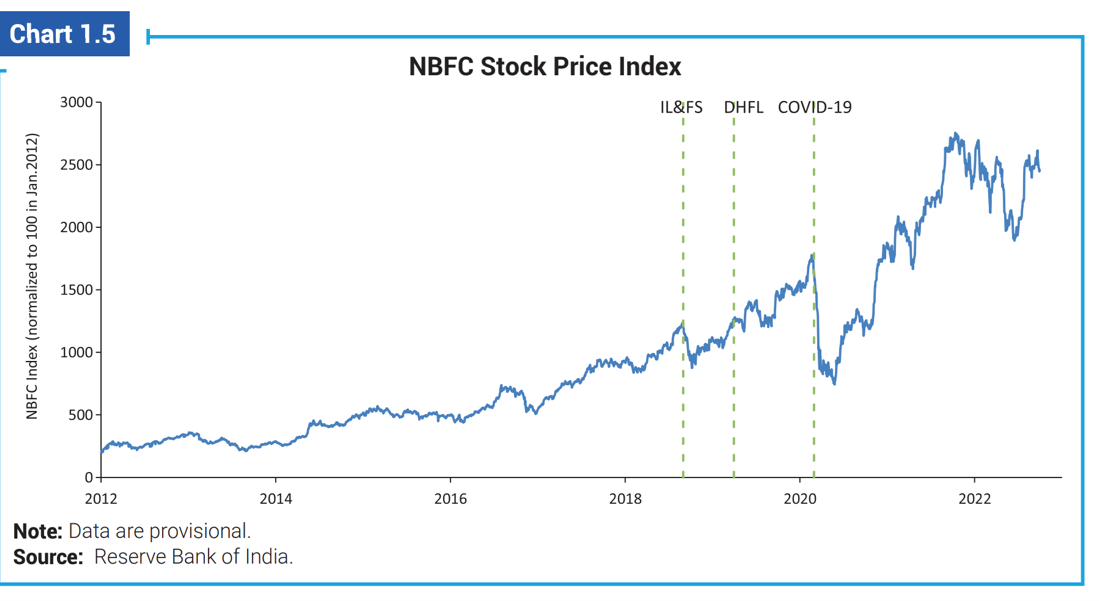

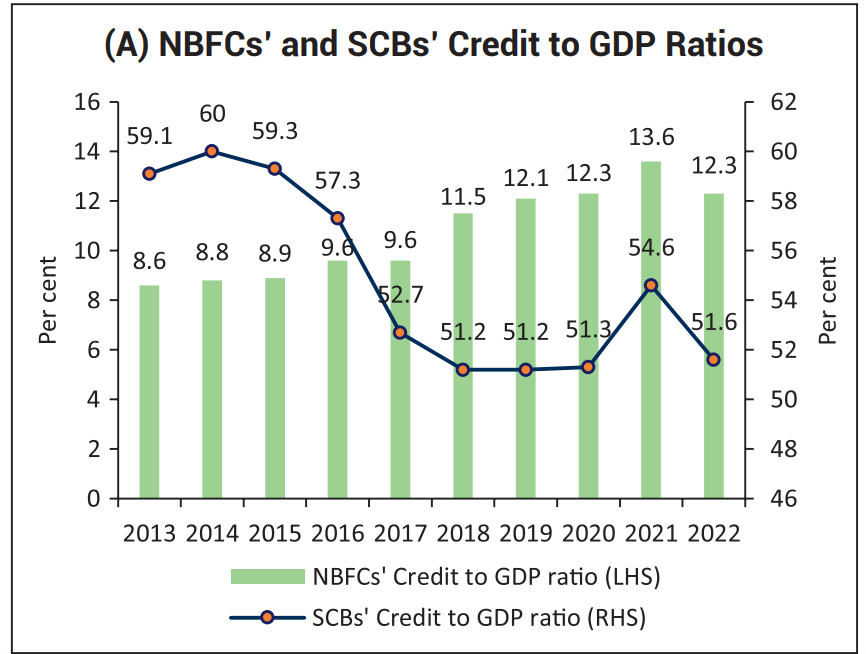

Picking sectors for investing is a task. With a broad-based rally in the stock market, it is tough to identify businesses that are likely to do well and priced low. It may be a good idea to understand the cycles in these sectors to know the right time to enter. The non-banking finance companies that lend money to consumers and function as quasi-banks have made a strong comeback. The sector was in a crisis following Infrastructure Leasing and Financial Services, or IL&FS debacle. They are playing a significant role in expanding financial inclusion in India, according to the latest India Finance Report 2023 published by the Centre for Advanced Financial Research and Learning (CAFRAL). The report tells the story of the way the sector witnessed a rapid expansion after the global financial crisis when commercial banks cut their lending. The rapid expansion was stalled by the crisis witnessed by IL&FS and Dewan Housing and Finance Limited. The COVID-19 pandemic presented a further challenge to the financial services industry. However, a timely intervention by the government and the Reserve Bank of India ensured the industry was nursed back to health. Loans given by NBFCs now account for over 12% of GDP than 8.6% in 2018. Despite challenges, the NBFC sector has expanded credit growth. They are probably influencing the retail sector loan growth.

Financial markets are looking at NBFCs positively, too. Equity prices of major NBFCs gained over the past few years.

That shows the market confidence. The interest in NBFCs is also driven by the reduced risk premia on borrowings done by NBFCs from banks. The average borrowing rates are trending down to 10% to 14%, from 15% to 17% earlier. NBFCs borrow money from banks through commercial paper, according to India Ratings, an affiliate of global ratings agency FITCH. An analysis of such companies by the agency suggests that banks are showing confidence in the borrowing by NBFCs. ‘Strong support from banks have bolstered investor confidence in NBFCs and housing finance companies or HFCs and market liquidity materially,” said a recent release from India Ratings. “Overall, improvement in financing conditions and relatively stable funding costs have further catapulted to better returns, higher AUM growth and translating into a better credit profile,” it added. NBFCs are also attracting capital from private equity investors in India and abroad.

The structural growth story in NBFCs presents a better opportunity for future profits. As these companies gain new borrowers, they increase their interest income. Their margins are improving with an enhanced focus on technology-led distribution.

Overall, the enhanced scope of business that pushes NBFCs market share is good news for the sector. The overall NBFC credit-to-GDP ratio is still relatively less compared to commercial banks. There is a visible decline in the commercial bank’s market share and a rise in NBFCs. As investors, you may want to identify the right companies with solid fundamentals to add to your basket of stocks. If you need help, you can get a professional to help you or use technology to identify them.

References:

https://www.indiaratings.co.in/pressrelease/67056

https://www.cafral.org.in/sfControl/content/NewsEvent/CAFRAL_Report.pdf

Thank you for reading this post, don't forget to subscribe!