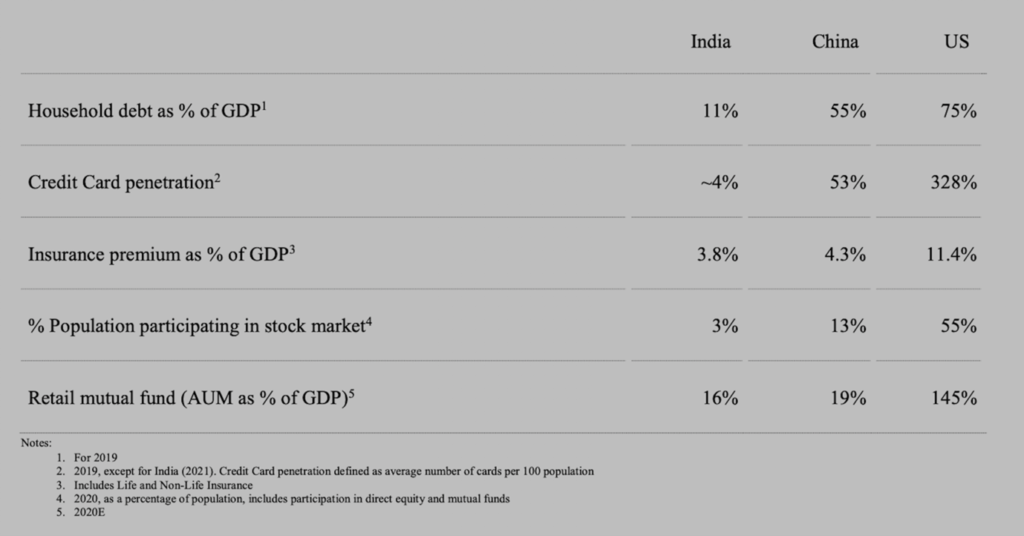

Not many people invest in India’s stock market. Merely 3% of India’s population directly get involved. In America, that is 55%. Retail mutual fund investors have assets equivalent to 16% of the gross domestic product or GDP. That is 145% in the US.

But when it comes to real estate and gold, household participation is the highest.

When Indians buy gold, they do it based on their income status than the prevailing price. A report on the trend in the Indian gold demand by the World Gold Council, a global body, flagged it in their latest survey late last month. Gold is the most sought after asset class for Indian households. When they earn more, they buy more gold. That is irrespective of the record high prices of the yellow metal. If one goes by the investment rationale, you will buy gold when prices are low. However, Indian households tend to buy gold whenever they get more money. It is a sort of a ‘buy and hold’ asset in the form of jewellery.

There is familiarity or home bias. There is a comfort level that gold gives. As a result, Indian households are estimated to have over 23,000 tonnes of gold. That is three times the gold held by the US Federal Reserve, America’s central bank and the biggest hoarder of gold in the world.

Your emotions drive your investment decisions. Financial markets stoke emotions like ‘greed’ and ‘fear’. But even then, those could be triggered by behavioural biases. The recency bias could trigger greed or fear.

A survey backed by Charles Schwab, an American securities firm, found that the recency bias among investors grew to 58% in 2021 from 35% in 2019. There is an expectation among investors in America that the bullish trend would continue in the stock markets as businesses continue to report higher-than-expected profits. That drove a lot of retail investors towards stock markets. Besides that, the unemployment rate in America is ebbing and under control, and interest rates remain at a record low. The fear of inflation is no longer bothering investors.

There is a similar surge in retail investor interest in India’s stock market and mutual funds. A lot of that interest could be attributed to the recency bias and confidence in the one-way direction of the stock market.

How to deal with biases

Your investment decisions require a scientific or data-backed method to avoid pitfalls that emerge from biases. However, the simplest way to deal with biases is by changing your investment horizon. Equity investing requires you to stay invested for a long time. When you regularly invest in the stock market, you need to give your money time to grow. Riding through multiple investment cycles will allow you to generate returns that help with wealth creation.

Your investments also need the direction of your financial goals. It is a good idea to put goals upfront and designate your investments accordingly. They could be retirement, a child’s professional education, buying a home and others. When you do that, you will not take down that investment. Staying invested in equities for more than ten years is beneficial.

There are other ways to deal with behavioural biases. You need to train your mind to do a few things so that only data should drive your investment decisions and not emotions.

Diversification is another way to protect your investments from the risk of human biases. When you own multiple stocks in different sectors, you are spreading your risk. Yet again, you need to know when to buy into a particular industry and when to sell. Your decision cannot be based on things that your neighbour does. Herd mentality is another emotional aspect. You cannot buy or sell shares based on the fortune others have made. Share prices today are a reflection of tomorrow’s profits. Just because they were rising for the past few years does not mean they would do so today and tomorrow.

Taking professional help makes sense. You need financial advice to help you navigate through. Stock picking is a skill, and you can learn it over time. When buying and selling stock requires you to understand the concept of stock market valuation thoroughly. Things that influence the profitability of a business and sectors need to be understood before making a decision. If you cannot make sense of the knowledge or data, you may want to take help from those who can. Investing through mutual funds, index funds, exchange-traded funds regularly makes sense. You can also take help from companies that create direct to consumer investment platforms that offer multiple investment strategies with the help of statistical and quantitative models.

https://www.schwabassetmanagement.com/resource/addressing-surge-client-behavioral-biases

https://www.gold.org/goldhub/research/drivers-indian-gold-demand-india-gold-market-series

Thank you for reading this post, don't forget to subscribe!