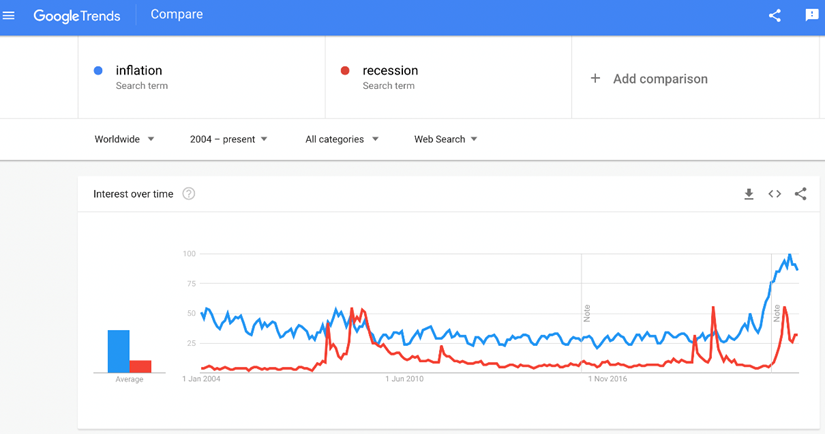

When financial markets witness high inflation episodes, they are usually followed by a recession. Online conversations and data intensify as high inflation triggers a chain of interest rate action by monetary policymakers worldwide. If you observe the Google Search Trend since 2004, you can find how searches around the term ‘inflation’ are followed by ‘recession’. They reflect the underlying sentiment at that time.

However, the past is no accurate barometer of the future. Many of the traditional inter-linkages between leading macro-economic indicators are less co-related due to coordinated action by Central Banks and Policy makers through periods of crisis and the aftermath.

In their latest projections, the International Monetary Fund and the World Bank already predict a weak global economic outlook and a recession in the Western world. Even as 2022 draws to a close, there is no end to the war in Europe. The world will continue to face supply-side shocks for food and commodities as Ukraine and Russia are significant suppliers of food and fertilizer. China continues to witness strict action against the pandemic’s spread. While conversations around the China +1 manufacturing strategy of multinationals will likely continue in 2023, it will take years before any action takes place.

India is hoping to be that plus 1. The government is gearing up incentives to attract multinational corporations to create jobs for the rising young population. In 2023, India will assume the presidency of the G20, which accounts for 85% of the world’s GDP. The government will likely use that opportunity to drum up support for investments in India.

What would markets do

The interest rate cycle will continue to weigh over markets. The year 2023 will continue to witness high-interest rates for businesses. As inflation is tamed, the pressure on profits could ease. In India, despite high-interest rates, credit growth is strong. There is a visible decline in the non-performing loans in the banking system, and public sector bank balance sheets are more robust than before. The government has generated substantial tax revenue in 2022-23, and the monthly collection of the goods and services tax is well over Rs 1.4 trillion. The year 2023 is likely to witness high capital spending by the government. At the same time, household spending will likely continue to drive consumer demand. Benchmark indices are already at a record high in anticipation of a more robust corporate financial performance in 2023.

India’s equity markets showed resilience in 2022 amidst intense rate hike action worldwide. For share prices to increase from the current level in 2023, you need to get a sense of earnings visibility in 2023 and beyond. We do not attempt to predict the future course of the markets but strive to create resilient models and solutions that outlast economic and market cycles. Alphaniti is relentlessly working hard to support “Middle India” in their pursuit of wealth creation. Go on and check out our newly launched Alphamind at www.alphaniti.com now.

Thank you for reading this post, don't forget to subscribe!